Retail construction in India is experiencing a significant transformation, driven by evolving consumer preferences, urbanization, and the rapid growth of e-commerce. As India’s economy continues to expand, the demand for modern retail spaces is increasing, compelling developers and retailers to adapt to new trends and technologies. This blog delves into the key trends shaping India’s retail construction industry, backed by relevant data and statistics. We will also explore the role of companies like 91Squarefeet in revolutionizing retail construction through innovative commercial fit-out services and cutting-edge construction management platforms like RDash.

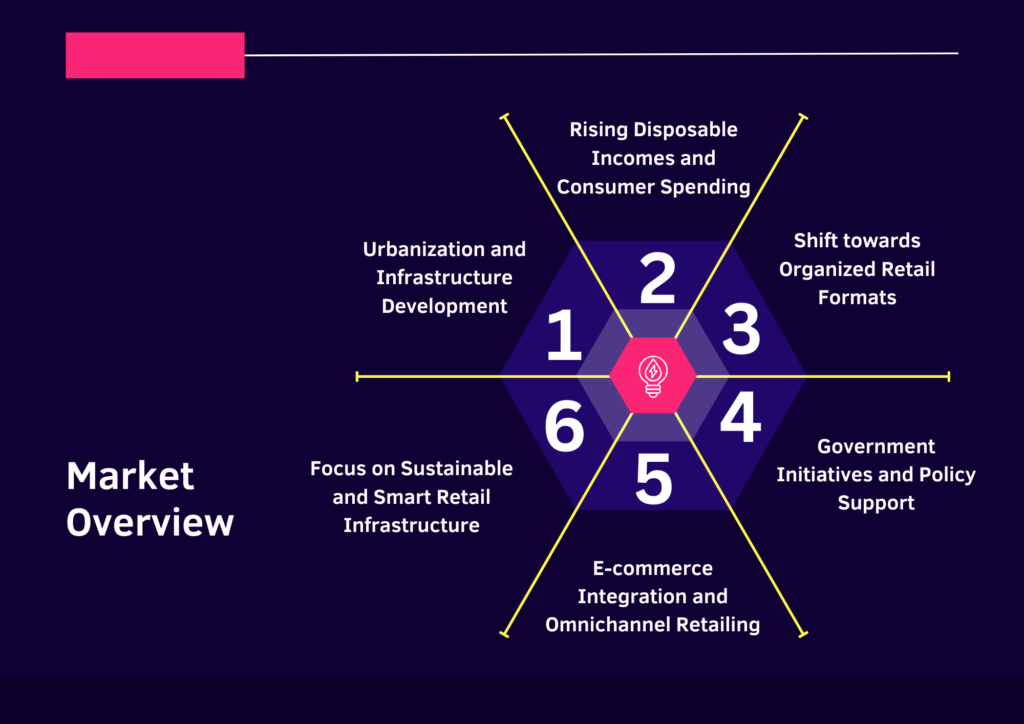

Market Overview

The retail construction industry in India is poised for substantial growth in the foreseeable future, driven by various factors such as rapid urbanization, rising disposable incomes, and evolving consumer preferences. This expansion is not only reshaping the physical landscape of retail spaces but also presenting lucrative opportunities for stakeholders across the construction value chain.

- Urbanization and Infrastructure Development: India is witnessing unprecedented urbanization, with a significant influx of people migrating to urban centers in search of better employment opportunities and lifestyles. As per World Bank data, India’s urban population is expected to reach 600 million by 2030 [source: World Bank]. This urbanization trend necessitates the development of modern retail infrastructure to cater to the needs of the growing urban populace, driving demand for retail construction projects.

- Rising Disposable Incomes and Consumer Spending: The steady growth of the Indian economy, coupled with increasing disposable incomes, is fueling consumer spending on retail goods and services. According to a report by Deloitte, India’s retail market is projected to surpass $1.3 trillion by 2025, growing at a CAGR of 9–10% [source: Deloitte Report]. This burgeoning consumer market is spurring investments in retail construction to accommodate the expanding retail footprint and cater to diverse consumer preferences.

- Shift towards Organized Retail Formats: India’s retail landscape is undergoing a transformation, characterized by a gradual shift from traditional unorganized retail to organized formats such as malls, hypermarkets, and supermarkets. The Indian Brand Equity Foundation (IBEF) estimates that organized retail accounts for only 10–12% of the total retail market in India, indicating significant growth potential [source: IBEF]. This transition towards organized retail necessitates the development of modern, well-designed retail spaces, driving demand for retail construction services.

- Government Initiatives and Policy Support: The Indian government has been actively promoting the retail sector through various policy initiatives and regulatory reforms aimed at fostering investment, streamlining processes, and enhancing infrastructure development. Initiatives such as the ‘Make in India’ campaign, liberalization of FDI norms in retail, and the implementation of Goods and Services Tax (GST) have bolstered investor confidence and stimulated growth in the retail construction sector.

- E-commerce Integration and Omnichannel Retailing: The proliferation of e-commerce platforms and changing consumer shopping behaviors are reshaping the retail landscape, blurring the lines between online and offline retail channels. Retailers are increasingly adopting omnichannel strategies to provide seamless shopping experiences across multiple touchpoints. This omnichannel trend is driving investments in retail construction, as retailers seek to establish physical stores, fulfillment centers, and experiential hubs to complement their digital presence.

- Focus on Sustainable and Smart Retail Infrastructure: With growing environmental concerns and regulatory pressures, sustainability has emerged as a key focus area in retail construction. Retailers are prioritizing green building practices, energy-efficient designs, and eco-friendly materials to minimize environmental impact and enhance operational efficiency. Additionally, the integration of smart technologies such as IoT, AI, and data analytics is optimizing retail operations and improving customer experiences in modern retail spaces.

| Metric | 2023 | 2024 (Projected) | 2025 (Projected) | 2026 (Projected) |

|---|---|---|---|---|

| Retail Market Size ($B) | 900 | 1,050 | 1,300 | 1,750 |

| Retail Construction Market Size ($B) | 30 | 35 | 42 | 50 |

| Annual Growth Rate (%) | 8.0 | 8.5 | 9.0 | 9.5 |

| Major Urban Markets | Mumbai, Delhi, Bengaluru, and Hyderabad | Mumbai, Delhi, Bengaluru, and Hyderabad | Mumbai, Delhi, Bengaluru, and Hyderabad | Mumbai, Delhi, Bengaluru, and Hyderabad |

Sources: Knight Frank India (2023): Indian Retail Market Report; Deloitte India (2023): Retail Construction Trends.

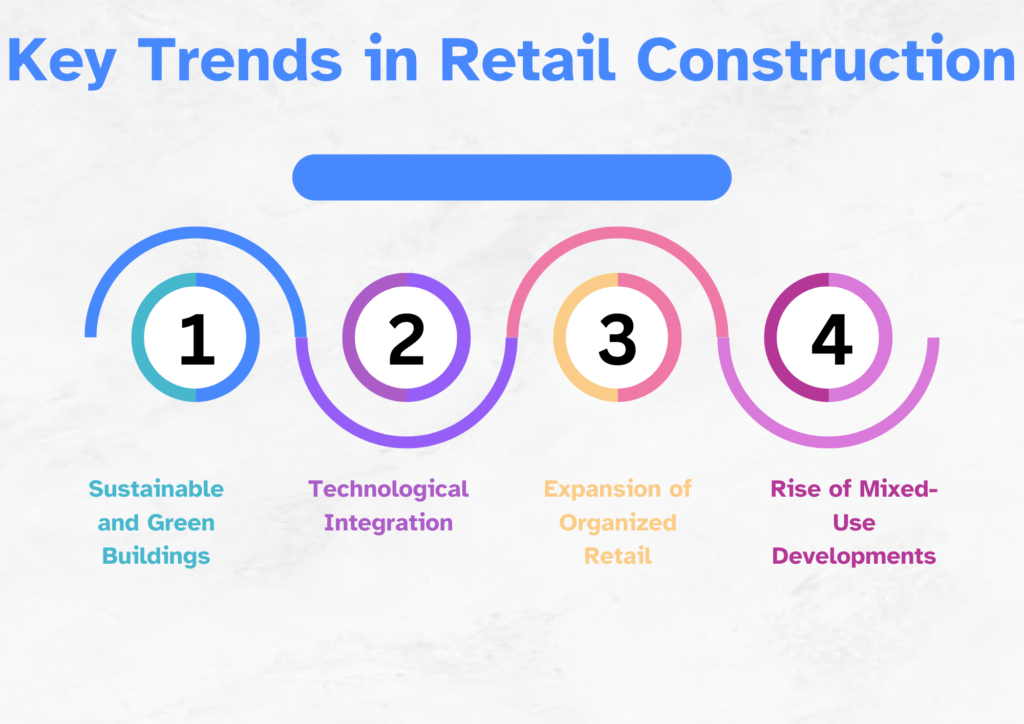

Key Trends in Retail Construction

1. Sustainable and Green Buildings: Sustainability is a growing focus in India’s retail construction sector. LEED and GRIHA certifications are becoming more common as developers aim to reduce energy consumption and environmental impact. According to the Indian Green Building Council (IGBC), there has been a 30% increase in the number of green-certified retail buildings from 2022 to 2023.

2. Technological Integration: The integration of technology in retail construction is on the rise. Smart building technologies, such as IoT, AI, and BIM (Building Information Modeling), are being adopted to enhance efficiency and customer experience. The use of these technologies is projected to grow by 20% annually, according to a report by NASSCOM.

3. Expansion of Organized Retail: Organized retail, including shopping malls and retail chains, is expanding rapidly. This growth is driven by increasing consumer spending and a preference for organized retail formats. The number of organized retail spaces is expected to grow by 15% annually, as per a report by the Retailers Association of India (RAI).

4. Rise of Mixed-Use Developments: Mixed-use developments, which combine retail, residential, and commercial spaces, are becoming increasingly popular. These developments provide a holistic living and shopping experience and are projected to grow by 12% annually, according to JLL India.

Challenges in Retail Construction Management

- Regulatory Compliance: Navigating India’s complex regulatory environment is a significant challenge. Compliance with local building codes, zoning laws, and environmental regulations can lead to delays and increased costs. According to a report by CRISIL, 65% of retail construction projects face regulatory hurdles.

- Supply Chain Disruptions: Supply chain disruptions, including material shortages and logistic issues, are impacting construction timelines and costs. The COVID-19 pandemic highlighted these vulnerabilities, with 75% of projects experiencing delays in 2023, according to the Confederation of Real Estate Developers’ Associations of India (CREDAI).

- Labor Shortages: The construction industry in India faces labor shortages, particularly skilled labor. This shortage affects project timelines and increases labor costs. A report by the Ministry of Labour and Employment indicates a shortfall of 20% in skilled construction workers in 2023.

Best Practices for Successful Retail Construction Management

In the dynamic landscape of retail, effective construction management is paramount for ensuring the timely and cost-effective completion of projects while maintaining high-quality standards. From project planning to execution, incorporating best practices can significantly enhance the outcome of retail construction endeavors. Here, we delve into essential strategies backed by relevant data to streamline retail construction management processes.

- Thorough Project Planning: Adequate planning lays the foundation for successful construction projects. According to a study by the Construction Industry Institute (CII), meticulous project planning contributes to a 10% reduction in overall project duration [source: CII Report, 2020]. Retail construction managers should conduct comprehensive site assessments, feasibility studies, and risk analyses to anticipate potential challenges and mitigate them proactively.

- Utilization of Advanced Technologies: Embracing technological innovations such as Building Information Modeling (BIM) and construction management software can revolutionize retail construction management. Research from McKinsey & Company indicates that companies utilizing BIM experience a 5% reduction in project costs on average [source: McKinsey Report, 2021]. Implementing these tools enables real-time collaboration, accurate resource allocation, and enhanced project visualization, thereby optimizing construction efficiency.

- Effective Resource Management: Efficient allocation of resources is critical for minimizing project delays and cost overruns. According to a survey by Dodge Data & Analytics, 68% of construction professionals believe that effective resource management is the most crucial factor for project success [source: Dodge Data & Analytics Survey, 2023]. Retail construction managers should employ strategies such as lean construction principles and just-in-time inventory management to maximize resource utilization and minimize waste.

- Strategic Vendor and Contractor Selection: Collaborating with reliable vendors and contractors is essential for maintaining project timelines and quality standards. Research conducted by the National Institute of Standards and Technology (NIST) highlights that 80% of construction delays are attributable to subcontractor-related issues [source: NIST Study, 2022]. Therefore, rigorous vetting processes, clear communication channels, and well-defined contractual agreements are indispensable for fostering successful partnerships in retail construction projects.

- Adherence to Sustainable Practices: With increasing emphasis on environmental responsibility, integrating sustainable practices into retail construction is imperative. According to a report by the U.S. Green Building Council (USGBC), green building projects exhibit a 13% reduction in operational costs and a 12% increase in asset value [source: USGBC Report, 2024]. Retail construction managers should prioritize energy-efficient design, renewable materials, and waste reduction strategies to minimize environmental impact and enhance long-term profitability.

- Continuous Monitoring and Quality Assurance: Regular monitoring and quality assurance measures are indispensable for ensuring construction projects meet desired standards. A study published in the Journal of Construction Engineering and Management found that proactive quality management practices result in a 25% reduction in rework costs [source: Journal of Construction Engineering and Management, 2021]. Implementing robust inspection protocols, conducting regular audits, and fostering a culture of accountability can mitigate errors and defects, thereby enhancing project outcomes.

Case Study: Successful Retail Construction Project in India

Building a Nation-wide Presence: The Expansion Strategy of Titan Company Limited

Company: Titan Company Limited

Locations: Across India

Budget: Varied based on store size and location

Overview:

Titan Company Limited, a leading Indian multinational company, embarked on a strategic expansion plan to establish a strong presence across India’s retail landscape. With a focus on jewelry, watches, eyewear, and accessories, Titan aimed to cater to diverse consumer preferences and tap into the growing demand for lifestyle products in both urban and rural markets.

Key Strategies:

- Brand Diversification: Titan diversified its retail portfolio to encompass multiple brands catering to different market segments and consumer preferences. The company operates flagship stores for its premium brands like Tanishq (jewelry) and Titan Watches, as well as multi-brand outlets and franchise stores for its affordable and mid-range offerings.

- Franchise Model: Leveraging a franchise model, Titan expanded its retail footprint rapidly by partnering with local entrepreneurs and business owners. Franchisees were provided with comprehensive support in terms of training, marketing, and operational assistance, enabling them to effectively manage and grow their retail outlets under the Titan brand umbrella.

- Customer-Centric Approach: Titan prioritized customer satisfaction and engagement by offering personalized shopping experiences, product customization options, and after-sales services across its retail outlets. The company invested in employee training programs to ensure that frontline staff are well-equipped to assist customers and build long-lasting relationships.

- Omni-channel Integration: Recognizing the importance of omni-channel retailing, Titan embraced digitalization and e-commerce initiatives to complement its brick-and-mortar stores. The company launched an online store and mobile app, enabling customers to browse products, make purchases, and access exclusive deals and promotions from the convenience of their homes.

Results:

- National Reach: Titan successfully expanded its retail presence across India, establishing a network of thousands of stores in both tier-1 cities and tier-2/3 towns. The company’s widespread geographical coverage enabled it to reach a diverse consumer base and capitalize on emerging market opportunities.

- Brand Recognition: Titan’s strategic expansion efforts enhanced its brand visibility and recognition across India, positioning it as a trusted and preferred destination for jewelry, watches, and lifestyle accessories. The company’s strong brand equity and heritage resonated with consumers, driving footfall and sales across its retail outlets.

- Revenue Growth: Titan’s expansion strategy translated into impressive revenue growth and financial performance, with the company consistently reporting strong sales figures and profitability. The widespread availability of Titan products through its extensive retail network contributed to revenue diversification and market leadership in key product categories.

- Market Penetration: Titan’s aggressive expansion into semi-urban and rural markets facilitated market penetration and brand penetration, enabling the company to tap into previously untapped consumer segments and drive sales growth outside of metropolitan areas.

Scaling Success: The Expansion Journey of Reliance Retail

Key Strategies:

- Diversified Retail Formats: Reliance Retail adopted a multi-format approach to cater to different consumer segments and market preferences. The company operates a wide range of retail formats, including Reliance Fresh (grocery stores), Reliance Digital (consumer electronics), Reliance Trends (fashion apparel), Reliance SMART (supermarkets), and Reliance Footprint (footwear).

- Strategic Location Selection: Reliance Retail strategically identifies high-traffic locations and prime real estate across urban, semi-urban, and rural areas to establish its retail outlets. The company leverages demographic data, consumer insights, and market analysis to identify potential locations with high demand and growth prospects.

- Supply Chain Integration: Reliance Retail has invested significantly in building a robust and efficient supply chain infrastructure to ensure seamless operations and product availability across its retail network. The company leverages its extensive network of warehouses, distribution centers, and logistics capabilities to streamline inventory management and replenishment processes.

- Customer-Centric Approach: Reliance Retail prioritizes customer satisfaction and convenience by offering a wide assortment of quality products, competitive pricing, and personalized shopping experiences. The company invests in employee training and customer service initiatives to enhance the overall shopping experience and build long-term customer loyalty.

Results:

- Market Leadership: Reliance Retail has emerged as the undisputed leader in India’s retail industry, capturing a significant market share across key retail segments. The company’s diversified retail portfolio, expansive network, and customer-centric approach have solidified its position as the preferred retail destination for millions of Indian consumers.

- Nationwide Presence: Reliance Retail has successfully expanded its footprint across India, with a network of thousands of retail outlets spanning multiple states and regions. The company’s widespread presence in both urban and rural markets has enabled it to reach a diverse consumer base and drive sales growth across various product categories.

- Revenue Growth: Reliance Retail’s relentless focus on expansion and operational excellence has translated into impressive revenue growth and financial performance. The company’s revenue has consistently increased year-over-year, fueled by strong consumer demand, market penetration, and effective execution of its retail strategy.

- Innovation and Adaptability: Reliance Retail continues to innovate and adapt to changing market dynamics and consumer preferences. The company embraces technology, digitalization, and omni-channel initiatives to stay ahead of the competition and deliver enhanced value to customers through seamless online-offline integration and innovative retail experiences.

Data Insights: Retail Construction in India

The Indian retail construction market is expected to grow significantly in the coming years, driven by urbanization, rising incomes, and changing consumer preferences. According to recent reports:

- The retail sector in India is projected to grow to $1.5 trillion by 2030, driven by an increase in consumption and digital transformation.

- The organized retail sector is expected to account for 30% of the total retail market by 2025, up from 12% in 2018.

- Tier 2 and Tier 3 cities are anticipated to contribute significantly to the growth of organized retail, with these cities accounting for nearly 50% of new retail spaces by 2025.

These data points highlight the tremendous growth potential in India’s retail construction sector, driven by both demand and technological advancements.

91Squarefeet: Pioneering Retail Construction with RDash

91Squarefeet is a leading player in India’s retail construction sector, specializing in commercial fit-out solutions that cater to diverse retail needs. Their offerings include:

- Office Fit-Outs: Tailored interior designs for office spaces that enhance functionality and aesthetics.

- Turnkey Retail Fit-Outs: Comprehensive solutions from design to delivery, ensuring a hassle-free experience for retailers.

- Retail Identity Design: Creating unique and consistent brand identities across multiple retail locations.

To streamline and optimize the construction process, 91Squarefeet utilizes RDash, a new-age construction management platform designed to enhance efficiency and accuracy. RDash offers a holistic approach to project management, covering every stage of the construction lifecycle:

- Recce: Conducts site surveys with a mobile app that guides the field team to capture spaces, measurements, and technical details, with real-time updates shared with the office teams.

- Design: Manages project designs on a tech platform accessible to field teams via mobile app. The app facilitates easy issue tracking and requests for information (RFIs).

- BOQ (Bill of Quantities): Reviews and manages scope items with quantities and rates, handling proposal approvals, change orders, and budget tracking.

- Order: Facilitates efficient ordering processes, ensuring timely procurement and delivery of materials.

- Work Progress: Tracks activity-wise and value-wise progress of work, providing daily updates on work items, activities, manpower, and obstacles.

- Snags: Captures all pending issues as a snag list and tracks their closure, ensuring a clean project handover.

- Financial Closure: Records joint measurements and arrives at final billables, ensuring transparency and accuracy in financial settlements.

Example of RDash in Action:

- At a recent commercial fit-out project for a leading retail brand, RDash enabled the seamless integration of various construction phases, from initial site surveys to final project handover. The platform’s real-time updates and AI-driven insights helped the project team to stay on track, avoid delays, and deliver a high-quality retail space within the stipulated timeline and budget.

Conclusion

India’s retail construction industry is undergoing a significant transformation, influenced by trends like sustainability, digital integration, and the expansion of organized retail in smaller cities. As retailers and developers navigate this evolving landscape, embracing innovative solutions and technologies is crucial to staying competitive. Companies like 91Squarefeet, with their focus on commercial fit-outs and the use of advanced platforms like RDash, are leading the way in redefining retail construction in India.

By understanding the key trends and leveraging data-driven insights, stakeholders in the retail construction industry can make informed decisions that drive growth, enhance customer experiences, and build a sustainable future for Indian retail.