In the world of construction, delivering large-scale projects often requires more than just technical skill—it needs funding, strong planning, and smooth collaboration.That’s when Public-Private Partnerships (PPPs) become a useful option. PPPs are long-term contracts between the government and private companies to develop infrastructure like roads, bridges, schools, or hospitals. In this article, we’ll explore how PPPs work, their key stages like Preplanning, Procurement, Bidding, and Construction, and when it makes sense to use this type of contract.

What is a Public-Private Partnership (PPP)?

A Public-Private Partnership is a contract where the public sector (usually a government agency) partners with a private company to build and operate a construction project. The goal is to combine public needs with private sector efficiency, funding, and innovation.

Instead of the government funding the entire project upfront, the private partner may help with financing, construction, and sometimes even long-term operation and maintenance.

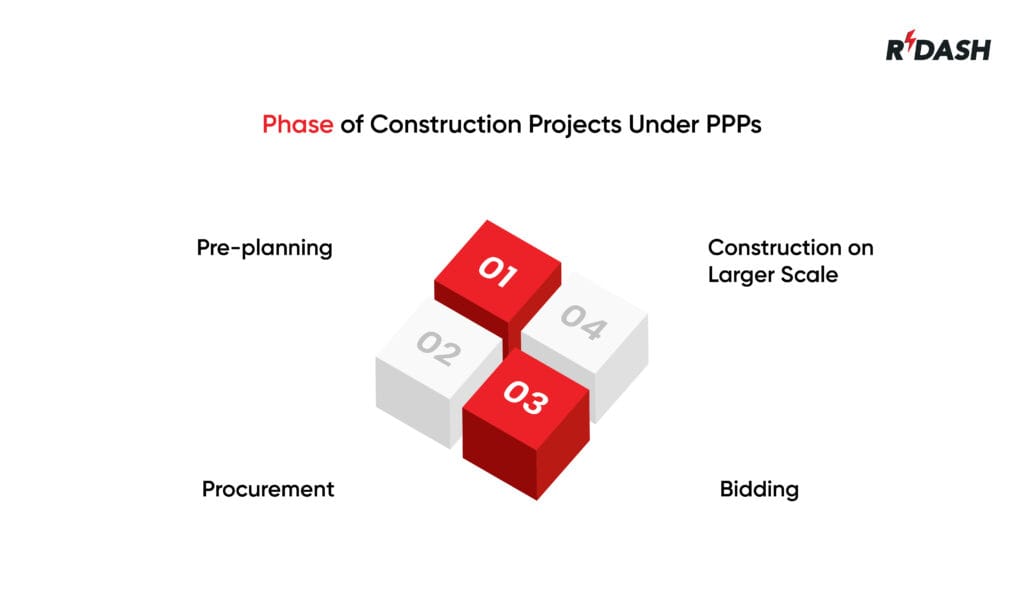

Stages of Public-Private Partnership (PPP) in Construction

The process of a Public-Private Partnership (PPP) in construction begins with preplanning. At this stage, the government identifies a public need, such as a new road, hospital, or power plant, and begins to explore whether a PPP is the right way to deliver it. Officials carry out studies, define the project’s scope and timeline, estimate costs, and assess the possible risks and long-term benefits. The goal here is to prepare a strong and clear business case before involving private companies.

Once the project is approved, the next step is procurement. During this stage, the government formally invites private companies to show interest by issuing documents like Requests for Proposals (RFPs). These documents outline the project’s details, technical needs, and evaluation criteria. Interested companies prepare their submissions, ask questions, and sometimes take part in meetings to clarify any concerns.

The bidding stage follows, where private firms submit their detailed proposals. These proposals include construction plans, financial models, timelines, and ideas on how to manage risks. The government carefully reviews all the proposals and selects the one that best fits the project’s goals. The selected company becomes the official private partner and signs a contract with the government.

After the agreement is signed, the construction phase begins. Since PPPs usually involve large and complex projects, construction happens on a much bigger scale compared to regular government contracts. The private partner is responsible for delivering the project as per the agreement, often including future operations or maintenance. With proper coordination, quality control, and monitoring, the construction phase leads to the successful completion and long-term use of the infrastructure.

Advantages of Using Public-Private Partnership (PPPs) in Construction

1. Access to Private Capital

One of the biggest advantages of PPPs is that they allow governments to build major infrastructure without paying the full cost upfront. Instead, the private company brings in funding, which reduces the pressure on government budgets. This is especially helpful when public funds are limited but urgent construction is needed.

2. Faster Project Completion

Private companies usually follow tighter timelines because delays can impact their earnings. As a result, PPP projects often move faster compared to those handled fully by the government. With PPPs, the design, approval, and construction stages can run side by side, which helps speed up the project.

3. Higher Efficiency

The private sector often uses modern equipment, advanced planning tools, and skilled project managers. This helps in completing the work with fewer delays and fewer mistakes, which leads to better use of resources and less waste.

4. Risk Sharing

In regular government contracts, most of the project risk is handled by the public sector. But with PPPs, the private company agrees to take on several types of risks, such as construction delays, cost overruns, or future maintenance issues. This protects the public side from unexpected costs.

5. Long-Term Maintenance

Many PPP projects go beyond just building—they also involve long-term care and management of the facility. This encourages the private company to build with quality materials and focus on durability, since they’ll be responsible for maintenance over the years.

6. Innovation and Better Solutions

Because the private sector wants to deliver quality within budget, they often bring innovative techniques, energy-saving designs, and new materials. These improvements can boost how well the infrastructure works and how long it lasts.

Challenges of Public-Private Partnerships

1. Complex Contracts

PPPs often involve large amounts of money and long timelines, so the contracts are detailed and take time to negotiate. This can slow down the early stages of the project and may require expert legal support.

2. High Initial Costs

Even though the government does not pay the full amount upfront, the private company needs to recover its investment. This can lead to higher tolls, user fees, or service charges for the public.

3. Limited Flexibility

Once the contract is signed, it can be hard to make changes. If government priorities shift or if user needs change over time, updating the contract could be costly or complicated.

4. Public Opposition

Sometimes, people don’t like the idea of private companies being involved in public infrastructure. If not managed properly, this can lead to protests or political pushback.

5. Monitoring and Accountability

Governments must closely monitor the private partner’s performance. Without regular checks, there is a risk that quality may drop or timelines may slip.

6. Political Risk

Changes in political leadership can affect PPP agreements. New governments may want to change terms, cancel deals, or delay payments, which adds uncertainty to the partnership.

Delivery Methods for Public-Private Partnership Projects

Public-Private Partnership (P3) projects can follow different delivery models depending on the type of infrastructure, project size, funding, and how much risk each side is willing to take. These delivery methods define how responsibilities are shared between the public and private partners.

One common method is Design-Build-Finance-Operate (DBFO). In this model, the private company designs the project, builds it, provides the funding, and later operates and maintains the facility for a long period. This is usually used in toll roads, airports, and energy projects. Another model is Build-Operate-Transfer (BOT), where the private company builds and operates the project for some years, and then transfers ownership back to the government. This approach helps governments get infrastructure without paying the full cost upfront.

Some projects may use Design-Build (DB), where the private partner only handles design and construction, while funding and operations remain with the public side. Another option is Lease-Develop-Operate (LDO), where the private company leases an existing public asset, upgrades it, and then runs it for profit.

Each delivery method has its own level of control, risk, and return. The right model depends on how involved the government wants to be and what results they expect from the project.

Other Contracts vs Public-Private Partnership Contracts

Traditional construction contracts and PPP contracts are quite different in how they are structured, managed, and delivered. In a traditional contract, the government typically funds the entire project and hires separate teams for design, construction, and maintenance. The public sector also takes most of the risk, whether it’s related to cost, delay, or performance issues. After the construction is completed, the private contractor’s role usually ends, and they are no longer involved in the project.

On the other hand, a Public-Private Partnership contract is designed for long-term collaboration. The private company is often responsible not only for construction but also for financing and sometimes for operating the project after it’s completed. This means they stay involved for years after the project is built. They take on more risk, but they also benefit from long-term earnings through service payments or user fees.

While traditional contracts give the government more control during construction, PPP contracts offer better efficiency, innovation, and shared responsibility. They are especially helpful when public funds are limited and when the project requires ongoing maintenance or complex operations.

FAQs

What types of projects are best suited for PPP contracts?

PPPs are best for large infrastructure projects such as highways, airports, hospitals, schools, and power plants, especially when long-term operations or maintenance is required.

How is a Public-Private Partnership Project funded?

The private partner often provides the initial funding, either from its own resources or through loans. The government may repay this through service payments, tolls, or revenue-sharing agreements.

What are the risks involved in a Public-Private Partnership?

Risks include cost overruns, construction delays, political changes, and lower-than-expected revenue. These risks are usually shared between the public and private sides, based on the contract.

Who owns the project in a PPP?

Ownership depends on the type of PPP. In some models, the private company owns it during the contract period and later transfers it to the government. In others, the government may retain ownership while the private party handles operations.

Is Public-Private Partnership the same as privatization?

No, they are different. In Public-Private Partnership, the government remains involved and sets the rules, while the private company only helps in delivering and operating the service. Privatization involves handing over complete ownership and decision-making power to a private company.

How long do Public-Private Partnership contracts usually last?

PPP contracts are long-term agreements, often lasting 15 to 30 years, depending on the project type and complexity.