When involved in a construction project, managing the financial and legal aspects can be as critical as the physical building process. One important aspect is the use of lien waivers. This article will explain discuss the different types available and how to create a waiver.

What is a lien waiver?

A lien waiver is an official document commonly used in construction to confirm payment and waive future lien rights. When a contractor, supplier, or other party gets paid for their work, they sign a lien waiver to confirm they have received the payment and waive any future lien rights against the property. This document helps protect property owners from the risk of having a lien placed on their property after they have already paid for the work, ensuring that no disputes over payment can lead to legal claims on the property.

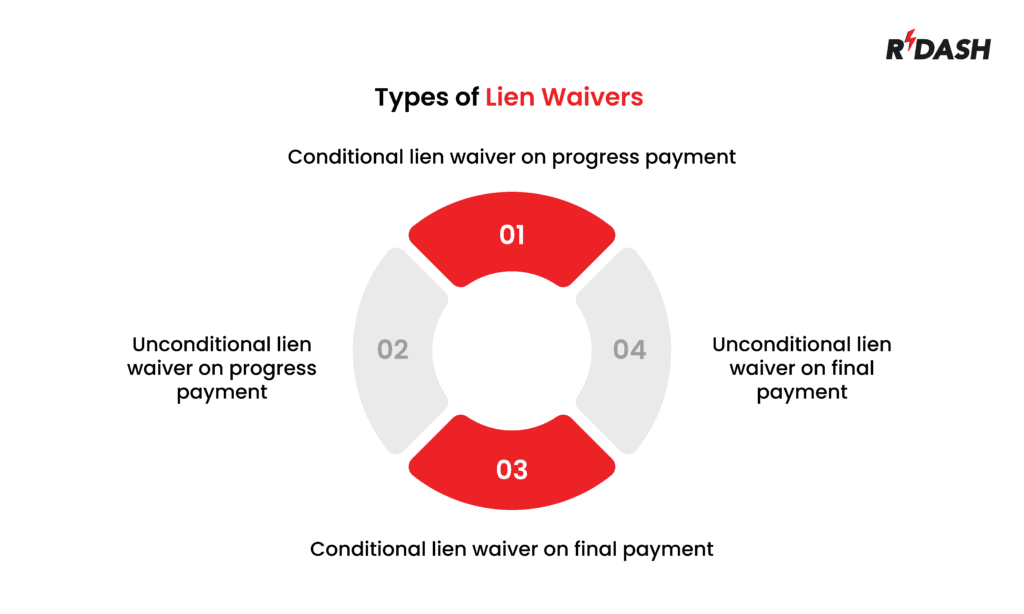

Different types of lien waivers

There are several types of lien waivers, each serving different stages of payment and offering varying levels of protection for those involved. Here are the main types commonly used in construction projects:

- Conditional lien waiver on progress payment: This waiver is used during the project when partial payments are made. It states that if the payment clears, the lien rights are waived up to the amount specified in the waiver. This type of waiver is conditional because it only takes effect if the payment is actually made and processed.

- Unconditional lien waiver on progress payment: Unlike its conditional counterpart, this waiver takes effect immediately upon signing and does not depend on the clearance of the payment. It’s typically used when payments are confirmed and no disputes about the payment exist.

- Conditional lien waiver on final payment: This waiver is used when the final payment on a project is being made. It is similar to the conditional waiver on progress payments but applies to the final amount due. The waiver becomes effective once the final payment is made and cleared.

- Unconditional lien waiver on final payment: This is used when the final payment on a project has been made and there is absolute certainty about the payment’s clearance. By signing this waiver, the claimant confirms that they have received the full final payment and waives any right to place a lien on the property.

The importance of getting a lien waiver right

Waivers play a crucial role in the construction industry, serving as a key document to manage financial risks and legal complications. Ensuring that a lien waiver is correctly completed and processed is vital for several reasons. Firstly, it secures the property owner from potential liens against their property once they have fulfilled payment obligations. This protection is critical because, without a proper lien waiver, property owners might face legal claims even after paying for the work. Secondly, for contractors and suppliers, executing a waiver correctly ensures that they accurately represent their payment status and legally relinquish their right to claim a lien, preventing any disputes about payment.

The accurate completion of waivers also maintains trust and transparency between parties, fostering smoother business relationships and facilitating ongoing professional interactions. Misunderstandings or errors in lien waivers can lead to project delays, additional legal costs, and strained relationships, which underscore the importance of getting these documents right.

How to create and fill out a lien waiver

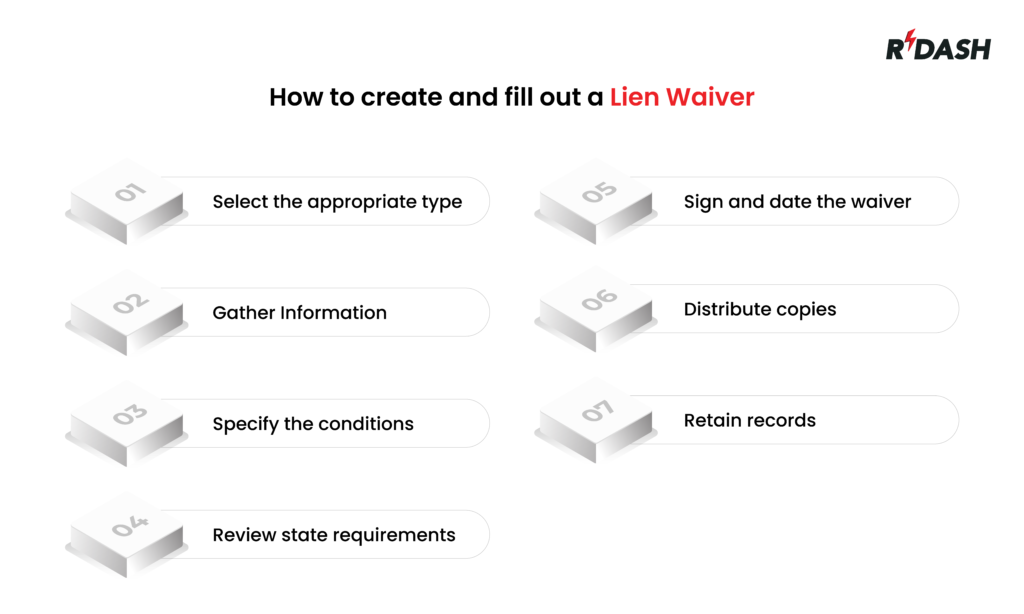

Creating and filling out a waiver requires attention to detail and an understanding of the specific terms that should be included. Here’s a step-by-step approach to handling this process:

Select the Appropriate Type : Determine whether a conditional or unconditional waiver is needed, and if it relates to a progress payment or the final payment. The choice depends on the payment stage and the security each party needs.

Gather Necessary Information: Include comprehensive details such as the project name, property details, the identity of the payer and the recipient, a description of the services or materials provided, and the payment amount that the waiver covers.

Specify the Waiver Conditions: Clearly state the conditions under which the waiver is effective. For conditional waivers, specify that the waiver’s validity is contingent upon the receipt and clearance of the payment. For unconditional waivers, confirm that payment has been received and processed.

Review State Requirements: Lien waivers are subject to state laws, which can vary significantly. Ensure that the lien waiver complies with the local regulations where the project is located to maintain its enforceability.

Sign and Date the Waiver: Once the waiver is filled out, all parties involved—the payee and, in some cases, the payer – should sign the document. Include the date of the signatures to document when the waiver was officially executed.

Distribute Copies: After signing, distribute copies of the signed waiver to all involved parties, including the property owner, the contractor, subcontractors, and suppliers, if applicable. Keeping everyone informed helps maintain transparency and ensures that all records are up-to-date.

Retain Records: Finally, securely store the signed lien waiver for your records. Keeping a well-organized file of all waivers and related payment documents can protect your interests in any future disputes or audits.

How to improve the lien waiver process

Improving the efficiency of the waiver process is crucial for speeding up transactions and reducing administrative burdens in construction projects. Here are several strategies to streamline this process:

- Use Digital Tools: Implementing digital management systems for lien waivers can dramatically improve efficiency. These tools can automate the creation, distribution, and storage of lien waivers, ensuring that they are filled out correctly and consistently.

- Standardize Templates: Develop standardized lien waiver templates that can be easily customized for different projects but retain essential legal terms. This reduces the time spent creating each waiver from scratch and helps prevent errors.

- Integrate with Payment Systems: Link your lien waiver process with your payment systems so that waivers can be automatically issued when payments are processed. This ensures that waivers are not overlooked and helps synchronize financial and legal records.

- Train Staff: Regularly train all team members involved in the financial and legal aspects of projects on the importance of lien waivers and how to manage them efficiently. Well-informed staff can prevent delays and manage documents more effectively.

- Regular Reviews: Periodically review your lien waiver processes to identify any bottlenecks or outdated practices that could be improved to enhance overall efficiency.

Lien Waivers vs. Lien Releases

While often used interchangeably, lien waivers and lien releases serve different purposes in the construction industry:

- Lien Waivers: These are provided before a lien is ever filed, typically at the time of payment. A waiver is a preemptive declaration by a contractor or supplier stating that they waive their right to file a lien for the amount specified once payment is received.

- Lien Releases: These are used after a lien has been filed against a property. A lien release is a legal document that removes the lien from the public record, typically after the claim has been satisfied or a dispute has been resolved.

Understanding the distinction helps ensure that the correct document is used in transactions, maintaining legal clarity and protecting all parties’ interests.

Common Questions

Who provides a lien waiver?

A waiver is usually provided by the contractor, subcontractor, or supplier receiving payment. It serves as their acknowledgment that they have been paid for services or materials provided up to that point and agree not to file a lien for that amount.

Why provide a lien waiver?

Providing a waiver is beneficial for several reasons:

- It assures the property owner that no liens will be placed on their property for the amounts paid, securing their investment.

- It facilitates a smoother payment process by providing peace of mind to all parties involved.

- It is often a required document before further payments are released, ensuring ongoing financial and legal clarity throughout the project duration.

By enhancing understanding and management of lien waivers and lien releases, construction projects can proceed more smoothly with reduced risk of financial or legal complications.