Cost Value Reconciliation in construction industry is a crucial financial management tool that plays a vital role in the construction industry. It helps businesses monitor and track project costs, revenue, and profitability. The process allows construction companies to assess whether a project is financially on track, where discrepancies exist, and how profitability can be improved moving forward. With the competitive nature of the construction sector, having a firm grasp of CVR can give companies a significant advantage.

For a construction project to stay financially healthy, CVR must be performed regularly, allowing managers to catch potential issues early and take corrective action.

Why cost value reconciliation in construction industry is important

The construction industry operates in an environment that involves high costs, tight deadlines, and often unpredictable variables. Effective financial management is crucial to keeping projects on track. This is where Cost Value Reconciliation becomes essential.

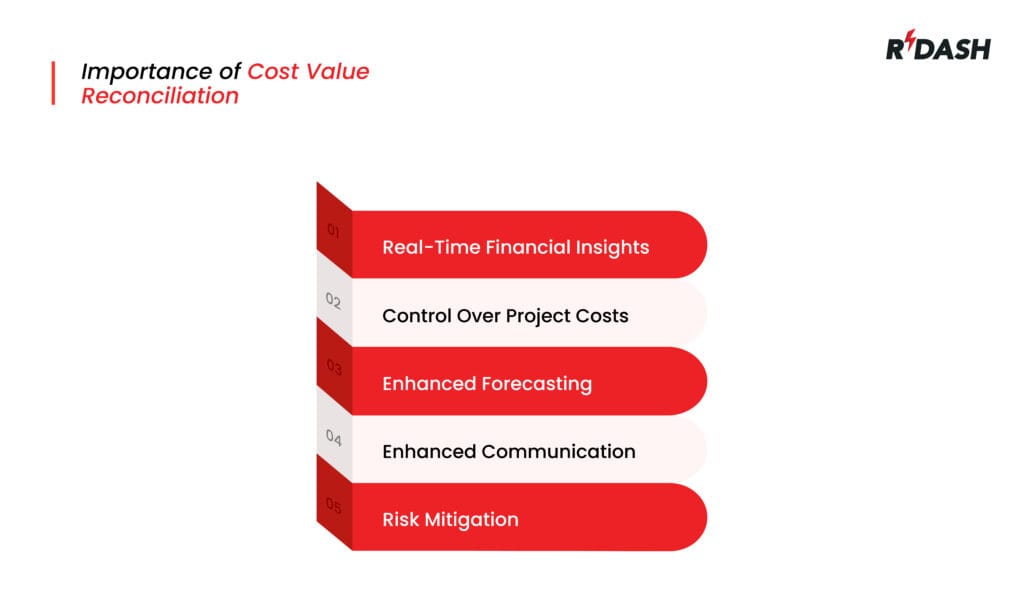

Here’s why CVR is so important in the construction sector:

- Real-Time Financial Insights: CVR provides real-time data on a project’s financial health, ensuring that managers have the most accurate and up-to-date information on hand. This allows them to make informed decisions swiftly, minimizing the risk of overspending or unforeseen losses.

- Control Over Project Costs: By comparing actual costs to anticipated revenues, CVR allows for the close monitoring of project expenses. This insight helps in controlling and, where possible, reducing unnecessary costs to improve the project’s overall profitability.

- Enhanced Forecasting: It’s common for construction projects to deviate from their initial plans. This involves the project management team, investors, and clients, making sure all parties have a clear understanding of the project’s financial status.

- Enhanced Communication: Cost Value Reconciliation offers a clear, concise summary of financial performance that can be communicated to various stakeholders. This includes the project management team, investors, and clients, ensuring that everyone is on the same page regarding project finances.

- Risk Mitigation: By identifying cost overruns early in the project lifecycle, CVR helps companies take corrective action to prevent financial issues from escalating. This is critical for avoiding risks that could affect the overall success of the project.

When should cost value reconciliation be done?

Cost Value Reconciliation (CVR) is an ongoing process essential throughout a project’s lifecycle, not just a one-time task. It should start with a baseline CVR at the project’s onset to establish initial cost estimates and revenue projections. As the project progresses, CVR should be conducted at significant milestones, like the completion of project phases or after significant deliverables are achieved, ensuring any cost discrepancies are identified and addressed promptly.

For longer projects, it is advisable to perform CVR monthly or quarterly to provide regular updates on financial performance, allowing for continuous oversight and preventing minor issues from escalating. Finally, a comprehensive CVR should be conducted at project closeout to assess the overall financial outcome, determine the project’s profitability, and gather valuable insights for future projects.

By conducting CVR regularly throughout a project, construction companies can stay on top of their finances, avoid nasty surprises, and maximize profitability.

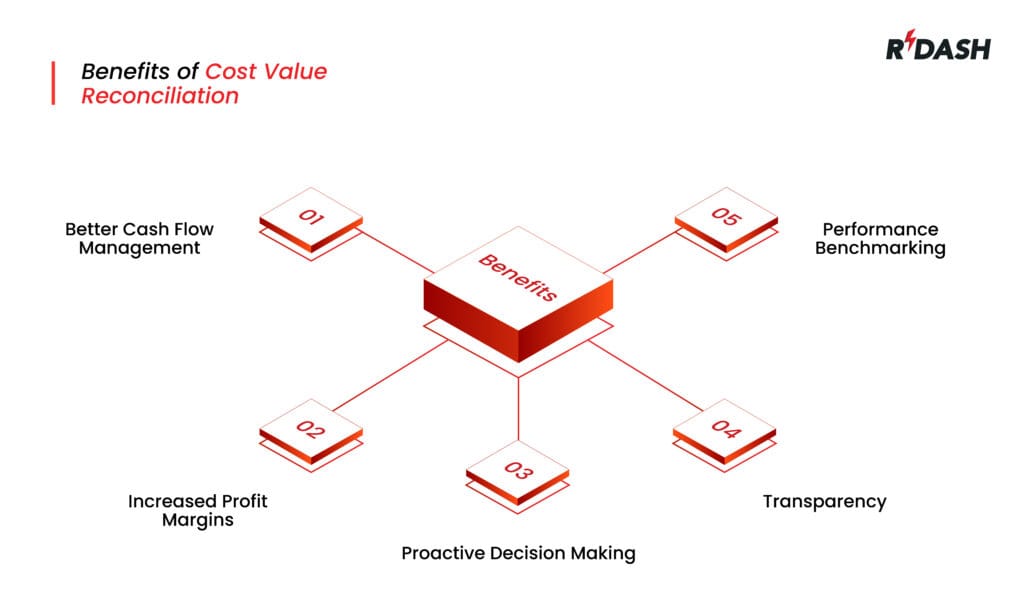

Benefits of cost value reconciliation in construction industry

Aside from the essential role it plays in managing project finances, CVR offers a range of additional benefits to construction businesses:

1. Better Cash Flow Management

With CVR, companies can track when and where their money is being spent, allowing for better cash flow management. This ensures that a company doesn’t run into liquidity issues mid-project, which can stall progress or force the company to take out expensive loans.

2. Increased Profit Margins

One of the key objectives of CVR is to improve a project’s profitability. By monitoring costs closely and making strategic decisions based on the data, companies can often increase profit margins. Identifying wasteful spending or unnecessary overhead early can have a significant positive impact on the bottom line.

3. Proactive Decision Making

Having regular updates on the financial performance of a project enables managers to make proactive decisions rather than reactive ones. For instance, if a project is trending toward a budget overrun, managers can adjust labor, materials, or timelines to keep costs under control.

4. Transparency with Clients

Cost Value Reconciliation also allows construction companies to maintain transparency with their clients. Regular financial updates keep clients informed about the project’s financial status, which helps to build trust and avoid disputes related to budget overruns or delayed payments.

5. Performance Benchmarking

CVR can also be used to compare the financial performance of different projects within a company. This allows businesses to benchmark performance, learn from successful projects, and identify areas where efficiency could be improved.

How can reconciliation be used?

CVR is also crucial for managing invoices and payments. It allows contractors to accurately value completed work before invoicing, reducing disputes and facilitating timely payments. Additionally, CVR offers objective data to monitor project progress, aligning actual performance with planned schedules and budgets, which helps keep projects on track.

Moreover, CVR is useful for performance benchmarking, allowing businesses to compare project costs and values to identify best practices and areas needing improvement. It also aids in resource allocation, giving businesses a clear view of where to adjust spending to optimize project execution.

Finally, CVR serves as a strategic tool for contract negotiations, providing a basis to renegotiate terms or request additional funds if costs exceed initial estimates. This versatility makes CVR indispensable for efficiently managing and executing projects, ensuring they stay within budget and on schedule.

FAQs

1. What’s the difference between Cost Value Reconciliation and budgeting?

Budgeting refers to the process of estimating the costs of a project before it begins, while Cost Value Reconciliation compares these estimates to actual expenditures and revenues to assess performance during the project.

2. Who is responsible for Cost Value Reconciliation in construction projects?

Typically, project managers, quantity surveyors, and financial teams collaborate to carry out CVR, ensuring all costs and revenues are accurately tracked and reported.

3. How does CVR help in managing project risks?

CVR helps identify financial risks early on by highlighting discrepancies between projected and actual costs, allowing companies to take corrective action before issues worsen.

4. What tools are commonly used for Cost Value Reconciliation?

Many companies use construction-specific financial software that integrates with project management tools, making it easier to track costs and revenues in real-time.

5. Can small construction projects benefit from CVR?

Absolutely. Even small projects can experience cost overruns or profitability issues. CVR helps ensure that every project, regardless of size, stays financially on track.

6. How often should CVR be done on a large project?

For large, complex projects, monthly or quarterly CVR reviews are recommended to maintain a clear understanding of the project’s financial status throughout its lifecycle.

Cost Value Reconciliation is an indispensable process for any construction company that wants to maintain control over its finances and ensure projects remain profitable. By implementing CVR throughout a project’s lifecycle, businesses can not only track costs and revenue but also make strategic decisions that drive better financial outcomes.