Financial tool play a crucial role in the success of any construction project by providing the necessary framework for effective financial management. They enable project managers to track expenses, forecast costs, and manage budgets in real-time, ensuring that projects stay within financial constraints. In today’s competitive construction environment, integrating these financial tools with project management software has become essential. This integration allows for seamless monitoring of project finances, helping to prevent cost overruns and delays, and ultimately improving profitability. By leveraging such tools, construction companies can enhance their financial oversight, streamline operations, and maintain a competitive edge in the market.

Why Financial Tools are Crucial in Construction Project Management

Construction projects involve complex financial transactions, including payments to suppliers and subcontractors and procuring materials and equipment. Managing these finances manually or through separate systems can lead to inefficiencies and errors.

Integrated financial tools provide a solution by consolidating all financial processes into a single platform. They automate tasks like invoicing, payments, and budget tracking, offering real-time insights into project finances. This improves decision-making and risk management.

By enhancing cash flow management and providing detailed financial reports, integrated tools help construction firms streamline operations, reduce risks, and improve profitability and growth.

Key Benefits of Using Integrated Financial Tools in Construction

- Comprehensive Financial Visibility: Integrated financial tools provide a unified view of all financial transactions in real time. This visibility allows project managers to monitor expenses, track budget performance, and forecast future financial needs accurately. Real-time data helps in making informed decisions, reducing the risk of cost overruns and enhancing financial control.

- Automated Financial Processes: Financial tools integrated with construction project management software automate critical processes such as invoicing, payments, and payroll management. This automation reduces manual errors, speeds up financial transactions, and ensures timely payments to vendors and employees, thereby maintaining smooth cash flow throughout the project lifecycle.

- Improved Budgeting and Cost Control: Accurate budgeting is vital for any construction project. Integrated financial tools enable project managers to set realistic budgets based on historical data and predictive analytics. These tools also track all costs associated with labor, materials, and equipment, helping to identify areas where cost savings can be achieved.

- Enhanced Cash Flow Management: Cash flow is a critical aspect of construction project management. Financial tools integrated into project management software provide real-time updates on cash inflows and outflows, helping managers maintain a healthy cash flow. This capability is crucial for avoiding liquidity issues that could halt project progress.

- Effective Risk Management: Financial tools help in identifying potential financial risks early in the project lifecycle. By analyzing financial data, project managers can detect trends that may indicate future problems, such as cost overruns or cash flow shortages, and take proactive measures to mitigate these risks.

- Better Financial Collaboration and Communication: With integrated financial tools, financial data becomes accessible to all stakeholders involved in the project. This transparency fosters better communication and collaboration between finance teams, project managers, and other departments, ensuring everyone is on the same page and reducing the likelihood of financial misunderstandings.

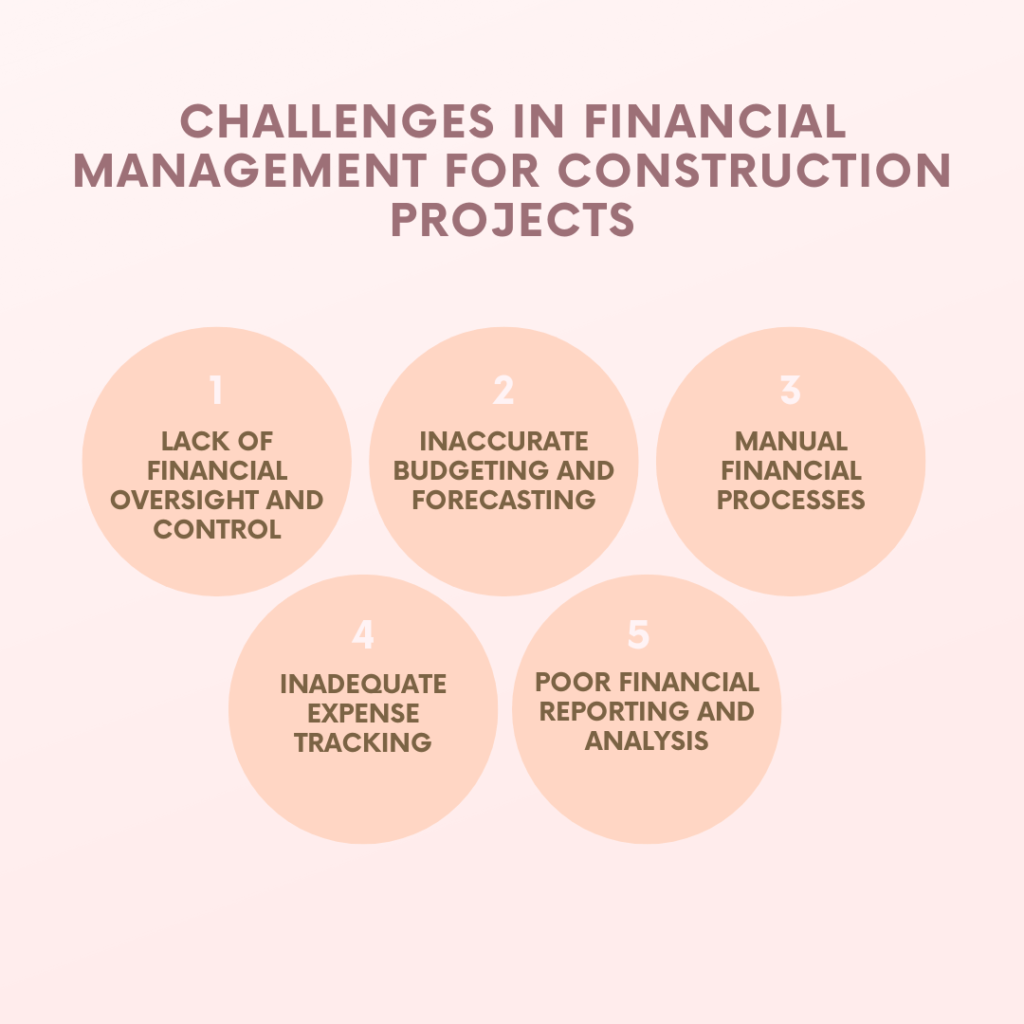

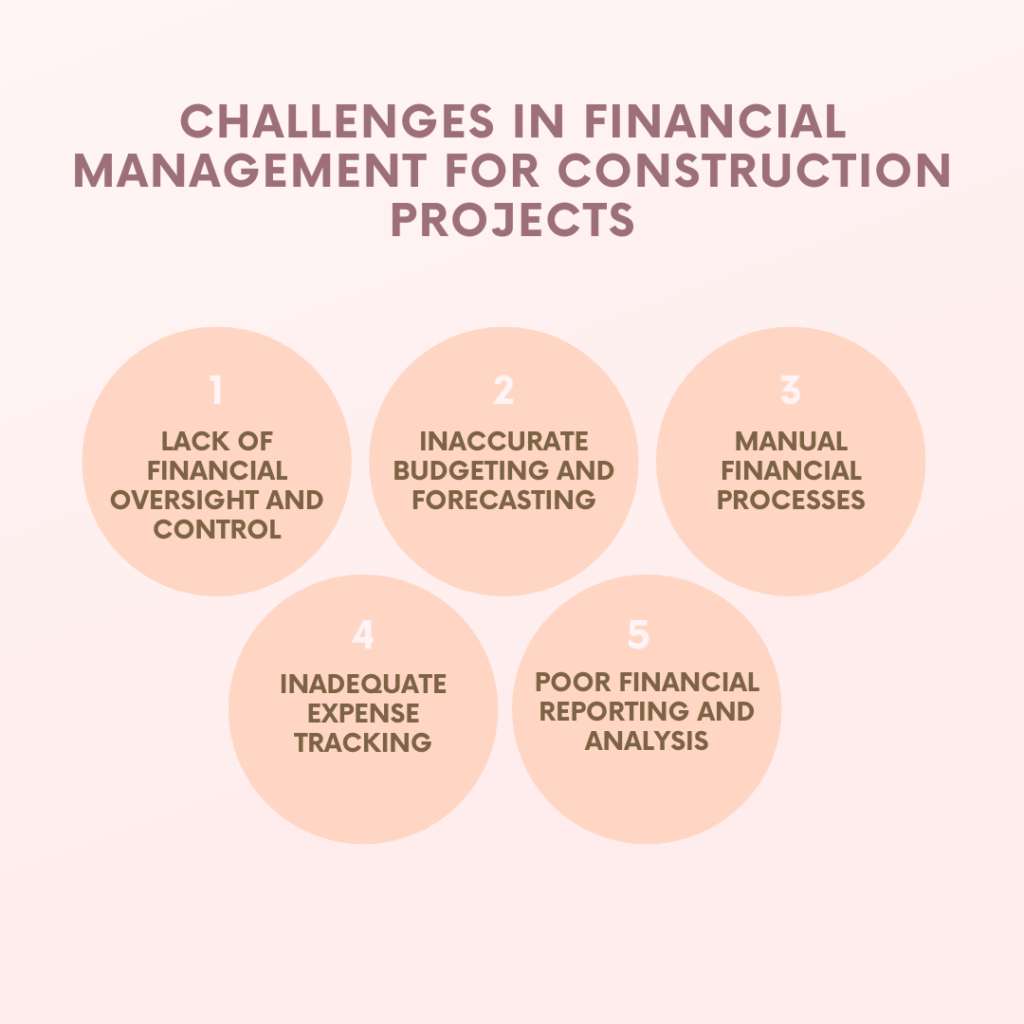

Challenges in Financial Management for Construction Projects

Despite the advantages of using integrated financial tools, construction companies often face several financial management challenges:

- Lack of Financial Oversight and Control: Many companies struggle with inadequate financial oversight, leading to poor cash flow management and unplanned expenses. Without integrated tools, it becomes challenging to track financial data accurately and ensure that all expenses are accounted for.

- Inaccurate Budgeting and Forecasting: Poor budgeting practices and inaccurate forecasting can lead to financial discrepancies and cost overruns. Integrated financial tools help in setting realistic budgets and providing accurate financial forecasts to avoid these issues.

- Manual Financial Processes: Manual processes are time-consuming and prone to errors, leading to delays in financial transactions and increased administrative costs. Automating these processes with integrated financial tools reduces errors and speeds up financial workflows.

- Inadequate Expense Tracking: Failing to track all project-related expenses accurately can result in financial discrepancies and potential losses. Integrated tools ensure that every expense is recorded and tagged to specific projects, providing a clear financial picture.

- Poor Financial Reporting and Analysis: Without proper financial tools, generating accurate financial reports and conducting thorough financial analysis becomes challenging. Integrated tools provide robust reporting capabilities, allowing companies to analyze financial performance and make data-driven decisions.

Best Practices for Utilizing Integrated Financial Tools in Construction

To effectively manage construction finances using integrated tools, consider the following best practices:

- Assign Unique Project Financial Codes: Assigning a unique financial code (e.g., JOB ID) to each project helps in tracking all associated expenses and revenues accurately. This practice ensures that all financial data is organized and easily accessible.

- Implement a Project Cash Flow Management System: Establishing a project-specific cash flow management system helps in maintaining financial control. This system should align with client and supplier payment terms to prevent cash flow shortages and ensure timely payments.

- Set Up a Financial Approval Mechanism: Implementing a financial approval process for project-related expenses helps in controlling costs and preventing unauthorized expenditures. This mechanism should involve finance controllers who review and approve all expenses.

- Use Predictive Analytics for Budgeting and Forecasting: Leveraging predictive analytics capabilities of integrated financial tools can improve budgeting accuracy and help forecast future costs more effectively. This approach reduces the likelihood of budget overruns and financial surprises.

- Integrate ERP Systems with Financial Tools: Integrating Enterprise Resource Planning (ERP) systems with financial tools ensures seamless data flow across all departments, enhancing overall financial accuracy and efficiency.

How RDash Enhances Financial Management in Construction

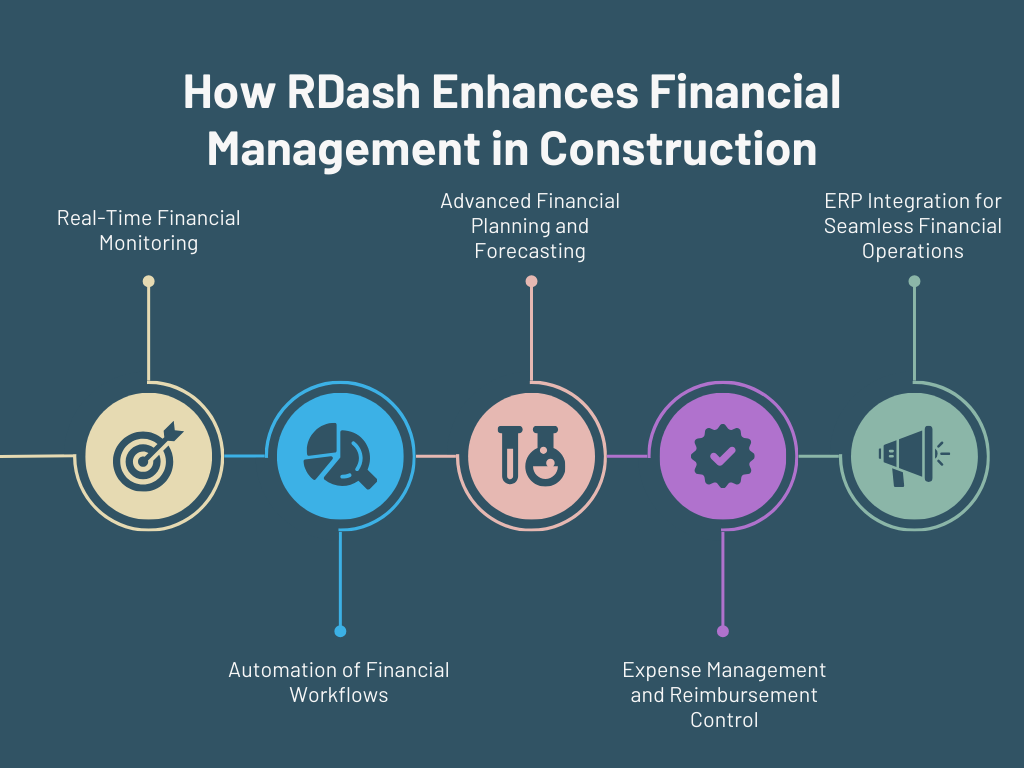

RDash, a construction management application, is specifically designed to integrate robust financial management tools with project management functionalities, offering a comprehensive solution for construction companies. Here’s how RDash addresses financial management challenges:

- Real-Time Financial Monitoring: RDash provides real-time insights into financial data, including expenses, revenues, and cash flows. This real-time monitoring helps project managers make informed decisions and maintain financial control.

- Automation of Financial Workflows: RDash automates key financial processes such as invoicing, payments, and expense approvals, reducing manual errors and speeding up financial transactions. This automation helps in maintaining a steady cash flow and ensuring timely payments.

- Advanced Financial Planning and Forecasting: With RDash, construction companies can utilize advanced financial planning tools to create accurate budgets and forecasts. These tools help in predicting future costs based on historical data, reducing the risk of financial surprises.

- Expense Management and Reimbursement Control: Every expense in RDash is tagged to a specific JOB ID, ensuring all costs are accounted for and providing a clear financial overview. The app also includes a reimbursement approval mechanism to maintain financial discipline.

- ERP Integration for Seamless Financial Operations: RDash seamlessly integrates with ERP systems, ensuring smooth data flow between finance, operations, and other departments. This integration enhances overall financial management and operational efficiency.

Real-World Application: 91Squarefeet and RDash

Take the example of 91Squarefeet, a construction firm that faced significant financial challenges, including unaccounted expenses, cost overruns, and poor reconciliation practices. These issues impacted the company’s profitability and project success rates.

By adopting RDash, 91Squarefeet was able to streamline its financial management processes. The app’s real-time financial tracking, automated workflows, and advanced planning tools helped the company improve cash flow management, reduce costs, and enhance financial visibility. As a result, 91Squarefeet achieved better financial control and improved project profitability.

Conclusion

Integrating financial tools with construction project management software is essential for achieving effective financial management in construction projects. Tools like RDash offer a comprehensive solution that enhances financial visibility, automates processes, and improves budgeting and forecasting accuracy. By leveraging integrated financial tools, construction companies can better manage their finances, reduce risks, and ensure successful project delivery.

For construction companies aiming to enhance their financial management capabilities, integrating financial tools with project management software like RDash is a strategic move. This integration not only streamlines financial operations but also provides a competitive edge in the construction industry by ensuring projects are completed on time, within budget, and with optimal profitability.