Budget management and project finance reconciliation are crucial components of successful construction project management. These processes ensure that projects are completed within the allocated budget, resources are utilized efficiently, and financial discrepancies are identified and resolved promptly. In this blog, we will explore the importance of budget management and project finance reconciliation in construction, discuss the key strategies for effective financial oversight, and provide real-world examples to illustrate these concepts.

Introduction to Budget Management and Project Finance Reconciliation

Budget Management involves the planning, allocation, and control of financial resources to ensure that a construction project is completed within the approved budget. This process includes estimating costs, tracking expenses, forecasting future costs, and making adjustments to stay within financial constraints.

Project Finance Reconciliation, on the other hand, is the process of comparing and adjusting financial records to ensure they are accurate and consistent with the actual financial transactions. This involves reviewing budgets against actual expenditures, identifying variances, and making necessary corrections to align financial reports with reality.

Both processes are integral to maintaining financial discipline, ensuring profitability, and avoiding cost overruns that can jeopardize project success.

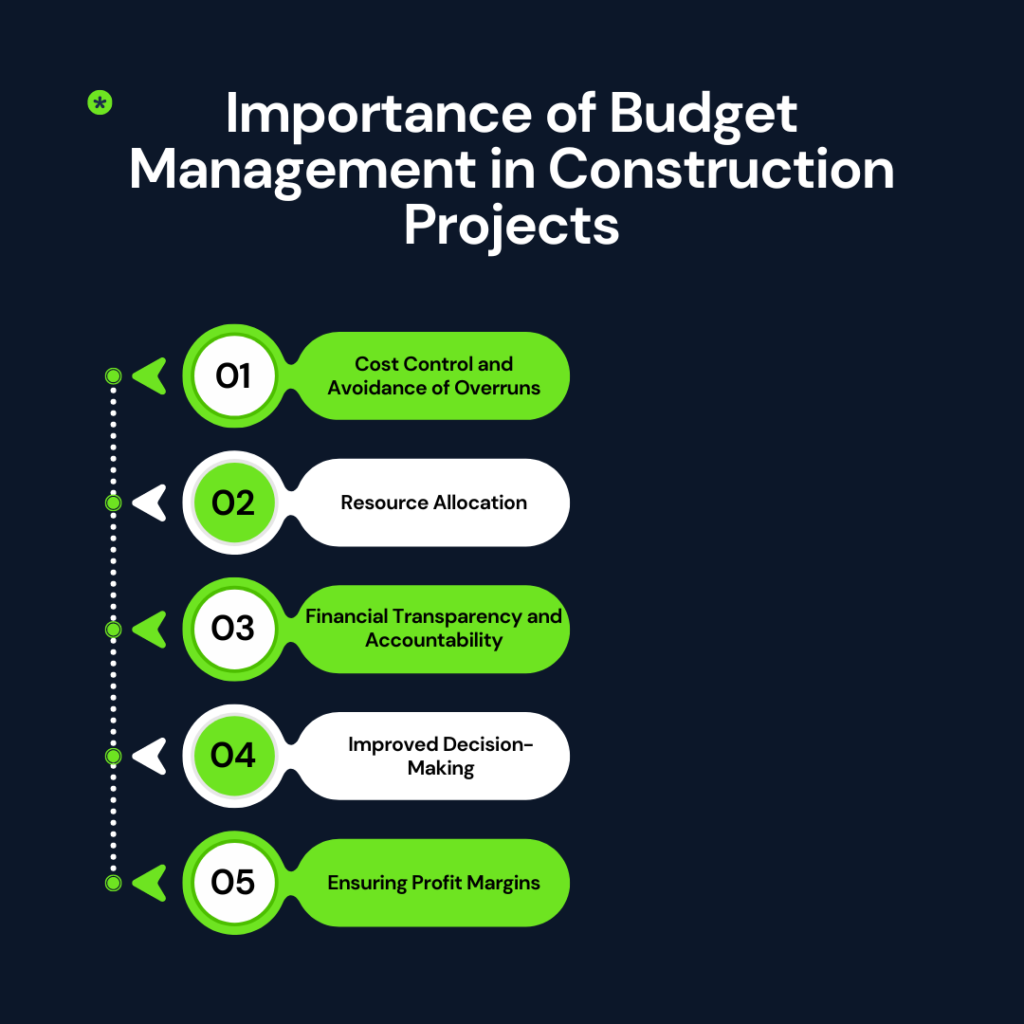

Importance of Budget Management in Construction Projects

- Cost Control and Avoidance of Overruns: Effective budget management helps prevent cost overruns by monitoring expenses and ensuring they align with the approved budget. This is particularly important in construction, where unforeseen issues such as design changes, labor shortages, and material price fluctuations can significantly impact costs.

- Resource Allocation: Proper budget management ensures that financial resources are allocated effectively, prioritizing critical aspects of the project without compromising quality. This involves allocating funds for various project components, including materials, labor, equipment, and overheads.

- Financial Transparency and Accountability: Maintaining a budget provides transparency and accountability, as it allows stakeholders to see how funds are being utilized. This fosters trust and confidence among investors, clients, and contractors.

- Improved Decision-Making: With a well-managed budget, project managers can make informed decisions regarding scope changes, risk management, and resource allocation. This helps avoid costly mistakes and ensures that the project progresses smoothly.

- Ensuring Profit Margins: For contractors and construction companies, effective budget management is essential to ensure that projects remain profitable. By controlling costs and minimizing waste, companies can protect their profit margins and avoid financial losses.

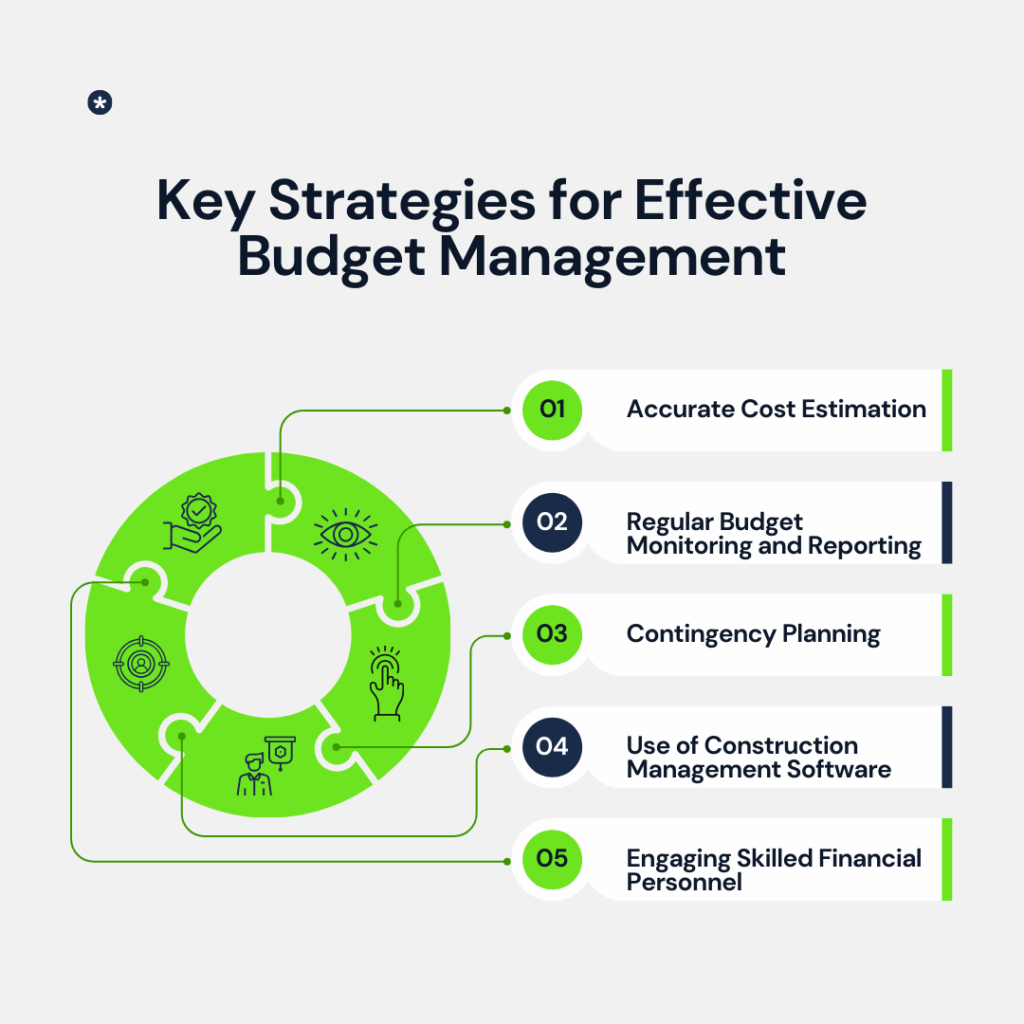

Key Strategies for Effective Budget Management

- Accurate Cost Estimation: The foundation of a solid budget is an accurate cost estimate. This involves calculating the costs of materials, labor, equipment, and overheads based on historical data, market research, and project specifications. Advanced tools such as Building Information Modeling (BIM) can also be utilized for more precise cost estimation.

- Regular Budget Monitoring and Reporting: Continuous monitoring of the budget is essential to track actual expenses against the planned budget. Regular financial reporting helps identify variances early, allowing for timely corrective actions. This can be done using software tools that provide real-time updates on expenditures and budget status.

- Contingency Planning: Every construction project should include a contingency fund to cover unexpected costs. This fund acts as a financial buffer, ensuring that unforeseen expenses do not derail the project. Typically, a contingency of 5-10% of the total budget is considered prudent, depending on the project’s complexity and risk profile.

- Use of Construction Management Software: Leveraging technology, such as construction management software, can greatly enhance budget management. These tools provide features like cost tracking, budget forecasting, and financial reporting, enabling better financial oversight and control.

- Engaging Skilled Financial Personnel: Having skilled financial professionals on the project team, such as cost accountants and financial analysts, is crucial for effective budget management. Their expertise in financial planning, cost control, and reconciliation ensures that the project remains financially sound.

Understanding Project Finance Reconciliation

Project finance reconciliation is the process of comparing and matching financial transactions recorded in the books against the actual financial activities that occurred. This process is vital for maintaining accurate financial records and ensuring that all project costs are accounted for correctly.

Steps Involved in Project Finance Reconciliation:

- Data Collection: Gather all financial documents related to the project, including invoices, receipts, purchase orders, bank statements, and payroll records.

- Transaction Matching: Compare the transactions recorded in the accounting system with the actual transactions reflected in the bank statements and other documents. This step involves verifying the accuracy of recorded amounts, dates, and payees.

- Variance Analysis: Identify any discrepancies between the recorded transactions and the actual transactions. Common discrepancies may include duplicate entries, missing transactions, incorrect amounts, or unauthorized expenses.

- Correction and Adjustment: Make necessary corrections to the financial records to resolve any discrepancies. This may involve adjusting journal entries, updating invoices, or reconciling bank statements.

- Reporting: Prepare reconciliation reports that summarize the variances identified and the corrective actions taken. These reports are essential for stakeholders to understand the financial status of the project.

- Continuous Improvement: Implement lessons learned from the reconciliation process to improve future financial management practices. This may involve enhancing internal controls, improving record-keeping procedures, or utilizing more advanced financial management tools.

Advantages of Project Finance Reconciliation

- Enhanced Financial Accuracy: Reconciliation ensures that financial records are accurate and reflect the true financial status of the project. This reduces the risk of financial misstatements and fraud.

- Improved Cash Flow Management: By identifying discrepancies early, reconciliation helps prevent cash flow issues that could affect project progress. It ensures that all expenses are accounted for and that funds are available when needed.

- Increased Stakeholder Confidence: Accurate and transparent financial records enhance stakeholder confidence in the project’s financial management. This is particularly important for investors, lenders, and clients who rely on financial reports to assess project viability.

- Regulatory Compliance: Regular reconciliation helps ensure compliance with financial regulations and accounting standards. This reduces the risk of legal issues and financial penalties.

- Better Risk Management: By identifying and resolving financial discrepancies early, reconciliation helps mitigate financial risks that could impact project success. It also provides insights into potential financial vulnerabilities that need to be addressed.

Challenges in Budget Management and Project Finance Reconciliation

- Complexity of Construction Projects: Construction projects often involve multiple stakeholders, subcontractors, and suppliers, each with their own financial records. This complexity can make budget management and reconciliation challenging.

- Data Accuracy and Availability: Accurate and timely data is essential for effective budget management and reconciliation. However, obtaining reliable data can be difficult, especially when dealing with multiple sources and manual record-keeping.

- Changing Project Scope and Costs: Changes in project scope, design modifications, and fluctuating material costs can make it difficult to maintain an accurate budget. These changes need to be accounted for in both budget management and reconciliation processes.

- Human Error: Errors in data entry, financial reporting, and reconciliation processes can lead to inaccurate financial records. This is particularly common in projects with manual record-keeping or inadequate financial controls.

- Lack of Skilled Personnel: Effective budget management and reconciliation require skilled financial professionals with expertise in construction finance. A lack of qualified personnel can hinder these processes and increase the risk of financial mismanagement.

Real-World Examples of Budget Management and Finance Reconciliation

Example 1: Construction of a High-Rise Building

During the construction of a high-rise building, the project team faced challenges related to fluctuating material prices and unexpected design changes. To manage these challenges, the project manager implemented strict budget monitoring and used construction management software to track expenses in real-time. Regular budget reviews were conducted, and a contingency fund was utilized to cover unexpected costs. Finance reconciliation was performed monthly to identify and resolve any discrepancies, ensuring that the project stayed within budget and was completed on time.

Example 2: Infrastructure Development Project

In an infrastructure development project, the project team discovered a significant discrepancy between the recorded expenses and the actual expenditures due to errors in manual data entry. To address this issue, the team conducted a thorough finance reconciliation, identified the errors, and made necessary adjustments to the financial records. The project manager also implemented additional financial controls and introduced automated data entry processes to prevent similar issues in the future. This approach not only resolved the discrepancies but also improved the overall accuracy of financial reporting.

Conclusion

Effective budget management and project finance reconciliation are critical to the success of construction projects. These processes help ensure that projects are completed within budget, financial resources are utilized efficiently, and financial discrepancies are identified and resolved promptly. By implementing key strategies such as accurate cost estimation, regular budget monitoring, contingency planning, and skilled financial oversight, construction companies can achieve better financial outcomes and enhance project success.

Furthermore, regular project finance reconciliation helps maintain financial accuracy, improve cash flow management, and increase stakeholder confidence. By overcoming the challenges associated with budget management and reconciliation, construction companies can ensure financial stability, regulatory compliance, and long-term profitability.

In conclusion, mastering budget management and project finance reconciliation is essential for any construction company aiming for success in today’s competitive market. By adopting best practices and leveraging modern tools and technologies, companies can achieve greater financial control, mitigate risks, and deliver successful projects that meet client expectations.