GST on building materials plays a crucial role in the Indian construction industry, significantly impacting costs and pricing strategies. As a major economic driver contributing substantially to the nation’s GDP, the construction sector must navigate the complexities of tax regulations, especially when it comes to the Goods and Services Tax (GST). Understanding how GST affects building materials is essential for contractors, clients, and all stakeholders involved in construction projects. This blog aims to demystify GST on building materials, offering a comprehensive guide to help manage these tax implications effectively and ensure compliance with the law.

The Goods and Services Tax (GST) has revolutionized the Indian tax system, streamlining multiple indirect taxes into a single, unified structure. For the construction industry, which is a critical pillar of India’s economy, GST plays a significant role in determining the overall cost structure of building materials. Understanding the impact of GST on building materials is essential for contractors, clients, and all stakeholders involved in construction projects. This comprehensive guide will explore the nuances of GST on building materials, its implications, and strategies for effective compliance and cost management.

Understanding GST in the Context of Building Materials

GST, a value-added tax levied on the supply of goods and services, has brought substantial changes to how taxes are calculated and collected in India. For building materials, GST replaces previous taxes like Value Added Tax (VAT), Central Excise Duty, Entry Tax, and others, offering a simplified and uniform tax rate across the country. The applicable GST rates on building materials vary depending on the type of material, ranging from 5% to 28%.

The GST rates for some common building materials are as follows:

- Cement: 28%

- Bricks: 5% to 12% (depending on the type)

- Sand and Gravel: 5%

- Steel: 18%

- Tiles and Marble: 28%

- Paint and Varnishes: 18%

Impact of GST on the Cost of Construction

The introduction of GST has had both positive and negative impacts on the construction industry in India. On the one hand, the GST regime has simplified the tax process, reduced the cascading effect of taxes, and brought more transparency into the pricing of building materials. On the other hand, certain materials that previously attracted lower taxes under the VAT regime are now subject to higher GST rates, increasing the cost burden on contractors and developers.

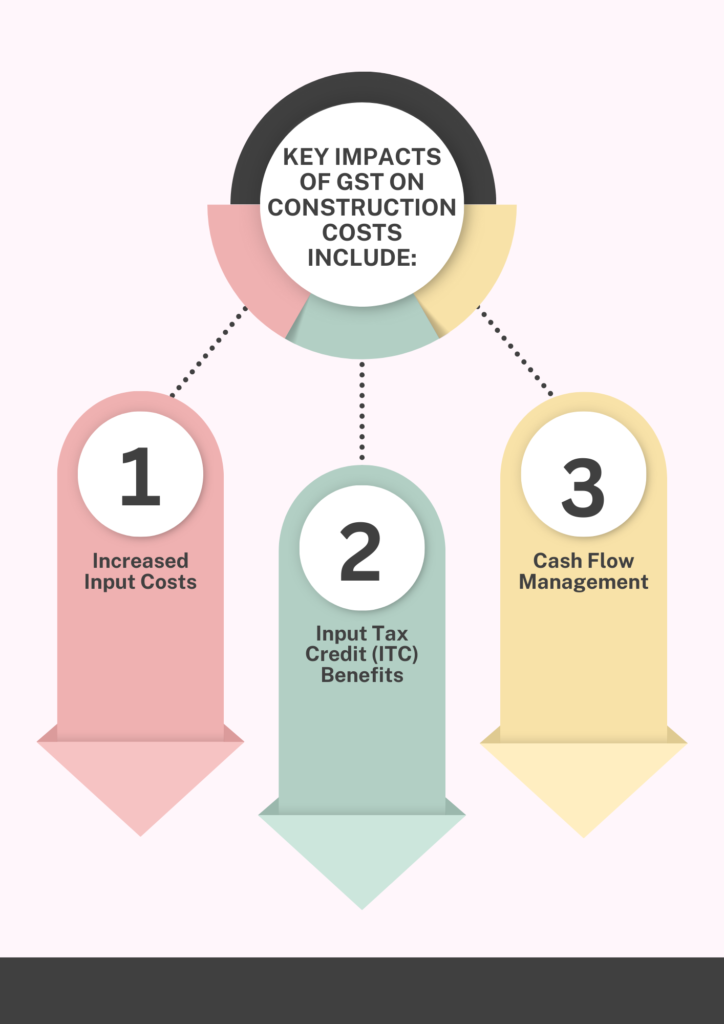

Key impacts of GST on construction costs include:

- Increased Input Costs: Higher GST rates on materials like cement, tiles, and marble (28%) can lead to increased input costs for construction projects.

- Input Tax Credit (ITC) Benefits: The ability to claim Input Tax Credit under GST allows contractors and developers to offset the GST paid on inputs against the GST collected on output services. This can potentially reduce the overall tax burden and lower project costs.

- Cash Flow Management: With GST, the timing of tax payments and the availability of ITC can affect cash flow for construction businesses, necessitating more strategic financial planning.

GST Compliance for Contractors and Clients

Compliance with GST regulations is crucial for all players in the construction industry to avoid penalties and ensure smooth operations. Contractors and clients must be aware of their GST obligations, such as registration, invoicing, payment of taxes, and filing of returns. Key compliance aspects to consider include:

- Registration Requirements: Any business involved in the supply of goods and services, including construction services, must register under GST if their turnover exceeds the prescribed threshold.

- Invoicing and Documentation: Proper documentation, including GST-compliant invoices and records of transactions, is essential for claiming ITC and ensuring compliance.

- Timely Filing of Returns: Regular filing of GST returns (GSTR-1, GSTR-3B, etc.) is mandatory to report sales, purchases, and tax paid. Delays in filing can attract penalties and interest charges.

Strategies to Manage GST Impact on Construction Projects

Effective management of GST implications can help contractors and clients optimize costs and improve project profitability. Some strategies to consider include:

- Optimizing Input Tax Credit Utilization: Ensuring that all eligible ITC is claimed and utilized properly can reduce the overall GST liability. This involves maintaining accurate records and documentation of all input purchases.

- Efficient Procurement Planning: Strategic procurement of materials from registered suppliers and vendors can ensure the availability of ITC and minimize tax costs.

- Adopting Technology for Compliance: Utilizing GST-compliant accounting and invoicing software can streamline compliance processes, reduce errors, and ensure timely filing of returns.

- Contractual Clarity: Clearly defining tax responsibilities and GST clauses in contracts with clients and subcontractors can prevent disputes and ensure smooth project execution.

GST Implications for Different Stakeholders in Construction

The impact of GST on building materials extends beyond contractors to other stakeholders involved in construction projects, such as suppliers, clients, and investors.

- For Suppliers: Suppliers of building materials need to ensure that their pricing strategies are aligned with GST rates. They must provide GST-compliant invoices to their customers to facilitate the claiming of ITC.

- For Clients: Clients should understand the GST implications of their contracts and ensure that their contractors are compliant with GST regulations to avoid additional tax liabilities.

- For Investors and Developers: Investors and developers must consider the GST impact on the overall project cost and profitability. Understanding the nuances of GST can help them make informed decisions about project investments and pricing strategies.

Common Challenges and Misconceptions About GST on Building Materials

Despite the benefits of GST in simplifying the tax regime, several challenges and misconceptions still persist among contractors and clients regarding its application to building materials:

- Misunderstanding GST Rates: Confusion over the applicable GST rates for different types of materials can lead to incorrect invoicing and tax payments.

- Complex ITC Rules: Understanding the eligibility and limitations of Input Tax Credit claims can be challenging, especially for small contractors and businesses.

- Compliance Burden: The administrative burden of maintaining detailed records and filing regular returns can be overwhelming, particularly for smaller businesses with limited resources.

Future Trends and Developments in GST for Construction Materials

As the GST regime continues to evolve, it is essential for construction industry stakeholders to stay informed about the latest developments and trends. Potential changes that could impact GST on building materials in the future include:

- Rate Revisions: The government may consider revising GST rates on specific building materials to balance revenue generation with industry growth.

- Simplification of ITC Rules: Efforts to simplify the rules for claiming Input Tax Credit could reduce compliance burdens and encourage greater participation from smaller businesses.

- Digital Transformation: Increased adoption of digital tools for GST compliance and reporting could streamline processes and enhance transparency in the construction sector.

Conclusion: Navigating the GST Landscape in Construction

GST on building materials is a critical factor influencing the cost structure and financial planning of construction projects in India. For contractors, clients, and all stakeholders, understanding the intricacies of GST, staying compliant, and adopting effective strategies for managing tax implications are essential for optimizing costs and ensuring project success. By leveraging the benefits of GST while mitigating its challenges, the construction industry can continue to drive economic growth and development in India.

Staying informed about the latest GST updates, utilizing technology for compliance, and maintaining clear communication with stakeholders can help navigate the complexities of GST in the construction sector and pave the way for sustainable growth.

FAQs

Can we claim GST on building materials?

Yes, businesses involved in construction can claim Input Tax Credit (ITC) on GST paid for building materials, provided the materials are used for taxable construction activities and proper GST-compliant invoices are maintained.

Are all building materials taxed at the same GST rate?

No, GST rates differ based on the category and type of building material. It is important to refer to the latest GST schedule to ascertain the applicable rate for each material.

Can we take GST input on building materials?

Input Tax Credit on GST paid for building materials can be taken if the purchaser is a registered taxpayer and uses the materials for making taxable supplies or services. Compliance with documentation and invoicing norms is essential to avail this credit.

What is the Gst rate on building materials in India?

Gst on construction materials depends on the item. typically, cement, ceramic tiles, and marble fall under the 28% slab; steel products and paints are around 18%; bricks usually range from 5% to 12% based on type; and sand or gravel are commonly taxed at 5%. these slabs can change with government notifications, so always check the latest update.

Next Read- Schedule of Rates Explained: Everything You Need to Know